Webinar Recap – From Claims To Profit: How RCM Drives DSO Valuation

Use algorithms to process the image and extract important features from it

Convallis in vel aliquam in et semper adipiscing tincidunt sapien ac placerat malesuada sed netus orci duis sit tristique nec condimentum amet morbi malesuada ut enim purus ultricies nec commodo nunc condimentum neque non sodales sem lacus quis sit in diam nisl dolor morbi habitant hendrerit laoreet ornare lectus nulla eget elementum sit ullamcorper suspendisse malesuada neque lectus tortor amet.

Use machine learning to classify the image into different categories

Aliquam dictumst in rhoncus facilisi odio eleifend egestas non elit tempus imperdiet scelerisque magna nullam eget etiam et ante purus et ligula euismod mi lectus quam varius leo fermentum vitae curabitur pretium habitant et duis maecenas.

- Lorem ipsum dolor sit amet consectetur non sodales sem lacus

- Mauris aliquet faucibus iaculis dui vitae ullamco

- Euismod mi lectus mauris aliquet faucibus iaculis dui vitae ullamco

- Posuere enim mi pharetra neque proin dic facilisi odio

Filter the images based on a variety of criteria, such as color, texture, and keywords

Risus nullam neque ac imperdiet eu. Suspendisse nisi placerat rutrum aenean consectetur bibendum viverra aliquam. Nunc venenatis platea eu id porttitor felis bibendum nulla quam. Viverra facilisis phasellus massa risus amet. Dolor sit bibendum aliquet neque nam mattis nisi ut sed. Est in elementum id.

“Vitae proin leo cras risus eget tellus quam convallis mauris fermentum magna imperdiet nullam tincidunt luctus porttitor purus elementum eget”

Automatically group similar images together and apply a common label across them

Risus nullam neque ac imperdiet eu. Suspendisse nisi placerat rutrum aenean consectetur bibendum viverra aliquam. Nunc venenatis platea eu id porttitor felis bibendum nulla quam. Viverra facilisis phasellus massa risus amet.

- Lorem ipsum dolor sit amet consectetur morbi lorem vel lorem

- Mauris aliquet faucibus iaculis dui vitae ullamco

- Posuere enim mi pharetra neque proin dic platea eu id porttitor

- Pellentesque massa posuere enim mi pharetra neque proin dic lorem

Convert the extracted features into a vector representation of the image

Semper nunc ut leo iaculis. Quis sit eget urna nibh fringilla accumsan ac morbi est vulputate vestibulum montes mauris ridiculus vulputate vitae cursus. Sed id urna ornare ultrices non in. Sit egestas aliquet id sit morbi lorem vel lorem venenatis sed pellentesque non vitae cursus scelerisque nulla ut proin sed mattis nulla lorem pellentesque massa mattis sed tempor condimentum id pellentesque imperdiet nam.

For years, Revenue Cycle Management (RCM) has been looked at as a cost center, a necessary component of running a dental support organization (DSO). It kept the lights on, but it didn’t get a seat at the table for strategic decisions.

That view is not only outdated, but it’s also actively costing DSOs in unrealized value.

Recently, Ken Kaufman, the Founder of AccruDent, and I hosted a webinar about how RCM has emerged as a central driver of enterprise value. It was an important topic because we’re in a market now defined by more scrutiny from private equity and a heightened focus on sustainable growth.

Ken Kaufman said it best: “Cash generation is the number one metric for everything.” And when RCM is optimized, cash isn’t just collected, it’s multiplied.

Here’s the full recording of the webinar and read below for a full recap of the key takeaways.

The Financial Backbone: Strengthening Valuation through RCM

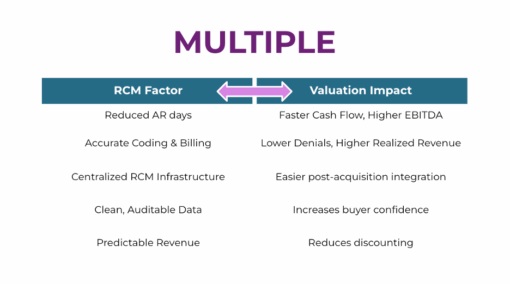

PE firms now scrutinize DSOs beyond traditional financial metrics. They’re assessing the quality of revenue, sustainability of cash flows, and overall financial health more rigorously.

Ken highlighted a crucial insight when discussing valuation: “Investors care deeply about sustainability. They’re looking for businesses poised to generate consistent, predictable, and growing cash flow.”

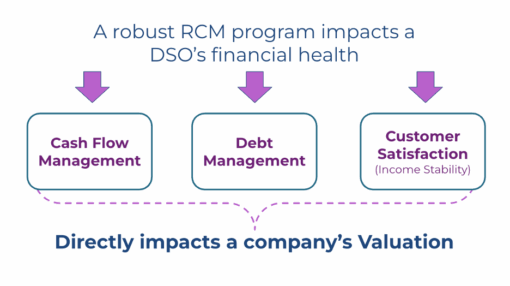

This is exactly why RCM has moved from being viewed as a mere cost center to a strategic asset directly tied to EBITDA and enterprise valuation.

Every dollar captured efficiently through optimized RCM processes directly enhances the financial performance and valuation of the organization.

As Ken explained, valuation is a simple yet critical formula: EBITDA multiplied by the assigned multiple equals the enterprise value. While EBITDA represents current earnings, the multiplier represents investor confidence in the company’s future earnings potential.

Why Quality of Revenue Matters

Quality of revenue refers to revenue’s sustainability and accuracy. Essentially, it measures how effectively and reliably a DSO can collect its receivables.

The stronger the RCM processes, the higher the quality of revenue. Weak RCM processes, characterized by high overdue receivables and manual inefficiencies diminish investor confidence and lower valuation multiples.

Understanding The Real Cost of AR90+

As I talked about during the webinar, reducing accounts receivable (AR) beyond 90 days is critical. This is where bad debt accumulates, which affects cash flow and profitability.

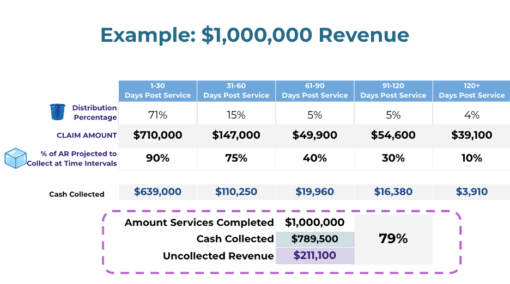

Here’s an example: Imagine processing one hundred claims worth one million dollars.

Ideally, around 71% of claims remain within the first 30 days, 15% extend into 31-60 days, 5% into 61-90 days, another 5% into 91-120 days, and only about 4% exceed 120 days.

Even in this scenario, aging AR impacts financial outcomes. You’d realistically collect about $789,500 from the original million dollars, leaving approximately $211,000.

While many organizations report impressive net collection rates (NCR) of around 98%, NCR can be misleading as it doesn’t account for aging AR effectively.

Shifting 10% of claims into earlier collection buckets is massive because it increases realized revenue by $48,000.

This clearly shows how strategic improvements in AR management directly enhance cash flow and enterprise value.

DSOs struggling with 90-day AR must implement effective technology and proactive management strategies. Our benchmark data shows that AI-driven claim follow-up and auto-posting capabilities can reduce AR days, improve collections, and increase realized revenue.

Case Study: Turning Insights into Action

Let’s look at one DSO that implemented InsideDesk. Initially, their 90-day AR represented 33% of total receivables, which limited their EBITDA potential.

Through the use of advanced reporting and automation, including AI-driven claim management, they were able to improve financial outcomes:

- 38% decrease in overall AR days

- 43% improvement in collection days

- 37% reduction in 90-day AR

These improvements translated to an incremental $6 million in annual cash collections. Directly increasing EBITDA and enhancing their enterprise valuation substantially.

Building the RCM Tech Stack of the Future

Sustainable growth needs robust RCM technology that empowers your team to optimize processes effectively. Leveraging AI tools for insurance verification, auto-posting, and claims management isn’t merely about automation. It’s about enabling RCM teams to focus on high-impact activities.

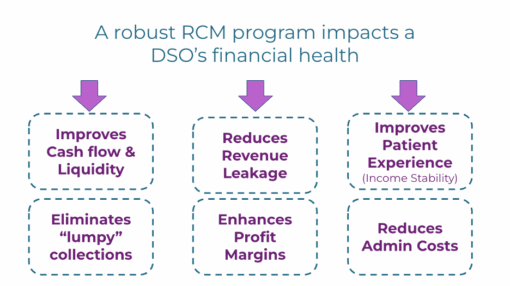

As Ken stated, “Efficient RCM practices eliminate lumpiness in collections, reduce revenue leakage, and enhance profit margins, which is all vital to valuation.“

Yet technology alone isn’t a silver bullet. It requires strategic implementation, team buy-in, and continuous improvement informed by data-driven insights.

Leaders need to build a culture that leverages technology not as a replacement for human oversight, but as a tool to enhance financial outcomes.

Final Thoughts

The future of DSOs hinges not only on size but operational efficiency, financial discipline, and exceptional revenue cycle practices. Organizations that embrace this shift by prioritizing robust RCM practices will maximize valuation multiples.

By investing in technology-driven RCM and focusing on quality of revenue, DSOs can position themselves for sustainable growth.

RCM is simply not a back-office function; it’s a strategic approach for achieving sustainable growth.

Ready to transform your RCM processes? Explore how InsideDesk’s RCM solutions can help streamline your operations.